Technology and life sciences companies have many new opportunities to receive federal research grants following the COVID-19 pandemic.

The National Institutes of Health (NIH), US Department of Defense (DOD), and other federal agencies continue to increase funding to technology and life science sectors. This is intended to support technological advancements and pharmaceutical solutions that address COVID-19 and other potential public health threats.

However, before accepting and spending these funds, companies should be aware of the many related compliance requirements. The below federal research grant compliance checklist can help your company benefit from the funding it needs without the compliance issues it doesn’t.

What Is Grant Compliance?

The federal government has long applied compliance requirements to regulate spending of taxpayer funds. These compliance requirements govern everything from the drawing down and spending of funds to the frequency and scope of audits.

They also outline disciplinary actions and ongoing compliance requirements that can affect an entity years after it spends granted funds. Compliance requirements can be significant and differ across federal agencies.

For more insight, read our article covering how to track COVID-19-related expenses and lost revenue for funding compliance.

Why Is Grant Compliance Important?

The federal government must view a grant recipient as a good steward of federal dollars. Maintaining compliance with federal government regulations enables companies to not only utilize federal dollars to fund operations, but also continue to apply for these funds and receive awards in the future. Disciplinary actions can be taken as a result of noncompliance, which can range from debarment from future federal funding to audits by a federal agency.

Will My Company Need to Be Audited If I Accept a Federal Grant?

Agencies’ audit requirements can differ. However, if a company spends over $750,000 of grant funding in a given year under an individual federal agency, it will likely need an audit of compliance and internal control over compliance for that year. These audits are typically due within nine months of year-end.

How Can a Company Reduce the Administrative Burden of a Federal Research Grant?

Your company’s processes and policies must be ready to accommodate receiving and managing a federal grant. The administrative burden for a grant is typically higher than that of privately funded grant research.

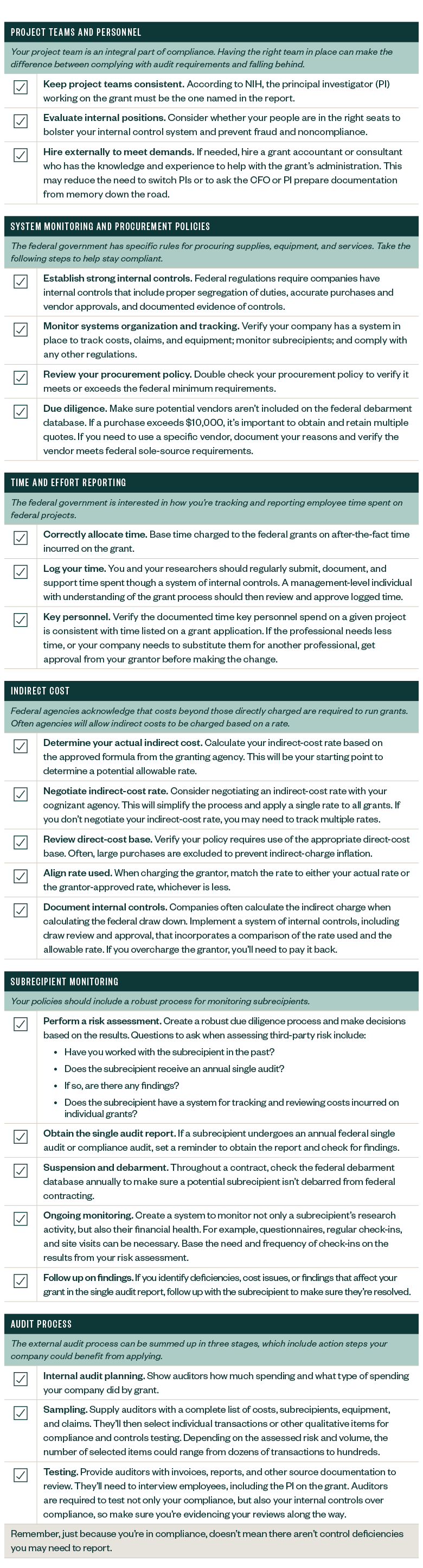

To prepare, your company can reference the following checklist.

Compliance Checklist: Prepare for a Federal Research Grant

Here are several steps your company can take to position its personnel structure, systems, policies, and procedures for grant compliance. Although this isn’t an exhaustive list, these steps can help your company get started.

If you’d like to view a PDF version of the checklist, please click here.

Top 5 Common Mistakes Discovered in Audit Findings

Following are the most common issues auditors find when auditing use of federal grants funds.

- The audit report is submitted after the deadline. That’s right, auditors are often approached by companies after the audit deadline has passed. This is usually because companies are unaware of the audit requirement.

- Costs are charged incorrectly. Supplies or salaries are often charged to the wrong grant due to a clerical error or lack of review. This is why it’s important to have an appropriate system in place for tracking your costs as well as appropriate levels of review.

- Procurement rules aren’t followed. Believe it or not, once you understand the rules, they’re easy to follow. It’s just a matter of documenting your thought processes and retaining documentation of quotes, bids, and bid analysis.

- Untracked use of budgeted time and effort. The federal government isn’t against budgeting time to be incurred on grants; however, it does want to see that researchers are tracking their time to be used in charging the grant. The auditor can’t validate that this happened unless researchers are tracking and documenting their time.

- Drawing too much funding at once. If your company draws funds, it’s important to carefully track the timing of each draw to use the funds quickly—or within the allotted three-day window. Many companies get around this issue by simply incurring their costs and drawing funds to retroactively cover these costs. But, for some companies, that isn’t a monetary option.

Applying a strong system of internal controls can help your company stay compliant with audit requirements. For more tips on how to implement and monitor your internal controls, see our articles:

- Efficiencies with Data and Internal Controls Could Translate to Revenue

- 3 Internal Control Considerations for the IPO Journey of Life Science Companies

We’re Here to Help

If you have any questions regarding federal research grant compliance, please contact your Moss Adams professional.